Comprehensive Retirement Sum is actually a essential notion in retirement preparing, particularly within specified national pension techniques. It signifies the amount of money that individuals have to have to acquire saved by their retirement age to be sure a steady stream of profits for the duration of their retirement a long time. This is an extensive overview:

Exactly what is the Complete Retirement Sum?

The entire Retirement Sum is essentially a focus on cost savings amount set by pension techniques or governments to aid retirees manage a simple conventional of living once they prevent Performing. It is intended to cover crucial fees like housing, Health care, and day by day living fees.

Vital Components

Age: The FRS normally applies any time you get to the Formal retirement age, which can differ dependant upon your country or particular pension plan.

Savings Accumulation: Through your Functioning lifetime, you contribute a percentage of your earnings into a specified retirement account.

Payout Framework: Upon achieving retirement age, these price savings are transformed into common payouts that supply economical help all through your retired everyday living.

So how exactly does it Perform?

Contributions:

All through work yrs, both equally workforce and businesses make contributions to the individual's retirement fund.

These contributions improve after some time by investments managed via the pension scheme.

Accumulation Stage:

The target is to build up enough money in this account to ensure it reaches or exceeds the FRS by the point you retire.

Payout Phase:

As soon as you hit retirement age and meet up with other eligibility conditions (like residency needs), you begin obtaining monthly payouts from this gathered sum.

These payouts are structured to past in the course of your predicted life span.

Why Can it be Essential?

Money Safety: Makes certain that retirees have ample money for simple desires without the need of only relying on other resources like relatives guidance or social welfare systems.

Inflation Protection: Numerous techniques change the FRS periodically to account for inflation and improvements in Value-of-living benchmarks.

Relief: Figuring out there’s a structured prepare for publish-retirement money alleviates strain about potential financial security.

Practical Instance

Imagine you might be thirty several years aged and starting off your first occupation using an once-a-year income of $fifty,000:

Each and every month, for instance 10% ($500) goes into your committed retirement fund—five% from you ($250) and 5% matched by your employer ($250).

In excess of a person calendar year, which is $six,000 contributed to your potential FRS.

Assuming a mean once-a-year return on investment decision of 5%, these savings will mature considerably after some time on account of compound curiosity.

By persistently contributing more than many many years whilst benefiting from compounded expansion prices and periodic changes for inflation made by pension authorities, you click here can expect to ideally get to or surpass the essential Total Retirement Sum on retiring at all around sixty five several years aged.

In summary:

The total Retirement Sum makes certain extended-phrase financial security in the course of non-working a long time.

Standard contributions coupled with strategic investments aid realize this goal sum.

Comprehension how it works empowers men and women to higher put together monetarily for their golden yrs.

By focusing on regular preserving patterns early in a single's profession and understanding how these money will probably be utilized in a while can result in more secure and pleasant retirements!

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Christina Ricci Then & Now!

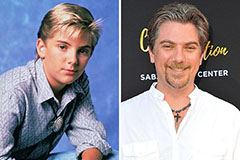

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!